Estate of Michael Jackson vs. Commissioner

Posted on May 25, 2021Download the PDF version here.

Evan Grooms and Nicole Stirling, Valuation Analysts at Hancock Firm, discuss the landmark ruling in detail below:

BACKGROUND [1]

In the recent Estate of Michael Jackson vs. Commissioner, Judge Mark Holmes noted that the Court “focuses on the nature of the estate tax as a tax on the privilege of passing on the property, not a tax on the privilege of receiving property.” This premise plays a particularly significant role in Judge Holmes’ opinion, as Jackson’s Estate had been deteriorating significantly in the years leading up to his death, as the Estate only grew in worth after Jackson’s death at the guidance of the Estate’s managers.

When Jackson’s Estate filed the Estate Tax Return, the IRS took issue with the valuation of three “intangible” assets found on the return:

1) Jackson’s image and likeness

2) New Horizon Trust II – Jackson’s interest in Sony/ATV

3) New Horizon Trust III – Jackson’s interest in Mijac Music

ASSETS UNDER SCRUTINY

During the IRS’s audit, the service assessed vastly different values for these three assets when compared to the values the Estate reported on the Estate Tax Return. Consequently, the IRS contended a much higher estate tax owed than what had been previously filed. The primary difference in the estimated value of Jackson’s Estate can be attributed to the varying levels of forecasted income between the IRS and the Estate. The Court determined the IRS’s expert, in general, did not appropriately weight the drastic reduction in popularity Jackson experienced in the final years leading up to his death in 2009, resulting in an overestimation of Jackson’s total Estate value.

JACKSON’S IMAGE AND LIKENESS

The use of a celebrity’s name and/or likeness can generate substantial income for whomever owns the rights to control it – it is viewed as a property right inherent to the value of a person’s identity. [2] Celebrities often capitalize on this property class by converting it to millions of dollars of income, especially when these individuals obtain high levels of popularity, like Michael Jackson once experienced. However, in Jackson’s case, his image and likeness had been smeared in the years prior to his death. This led the Estate to initially value Jackson’s image and likeness at $2,105 at the time the Estate Tax Return was filed.

After HBO’s release of the documentary “Leaving Neverland” in 2019, Jackson’s Estate increased the value of Jackson’s image and likeness to roughly $3.1 million. Nevertheless, this value remained about $400 million less than the IRS examiner’s estimation of value and over $150 million less than the IRS expert’s calculation.

Anson (the IRS’s expert), Roesler and Fishman (the Estate’s experts) each relied upon the Income Approach to value this “intangible” asset. However, Anson included hypothetical opportunities including potential merchandise branding, themed attractions, a Cirque du Soleil show, a film and a Broadway musical, which, according to the Court should not have been included in the “intangible” of likeness and image or were otherwise accounted for in the assets of the Estate. In addition, the Court determined the IRS’s expert included assets that were simply not foreseeable at the time of Jackson’s death. Accordingly, the Court determined Jackson’s likeness and image’s value to be $4,153,912.

JACKSON’S INTEREST IN SONY/ATV

The value derived from Jackson’s holdings in Sony/ATV is ultimately $0 according to Jackson’s Estate. Over the years, Jackson had assumed significant liabilities relating to his interest in Sony/ATV by repeatedly pledging it to obtain the cash needed to support his lifestyle. Further, Jackson gave up important bargaining rights with Sony to be able to obtain this cash. By doing so, Jackson completely offset any income he would receive from his interest in Sony/ATV. At the time of his death, Jackson’s associated liabilities exceeded any/all assets by approximately $89 million.

The IRS examiner, however, claimed that Jackson’s interest in the company was worth in excess of $469 million dollars while Anson, the IRS’s expert, claimed it was worth in excess of $206 million. Both Anson and Alan Wallis, another of the Estate’s experts, relied on the Income and Market Approach to value Jackson’s interest in Sony/ATV. Anson claimed, at the time of Jackson’s death, music publishing catalogs were regularly traded in an active market. Ultimately, the Court determined the IRS’s examiner and expert had not properly accounted for the liabilities Jackson had amassed or how the loss of bargaining rights negatively impacted his interest in the company. The Court agreed with Wallis and the Estate that Jackson had “squeezed ever dollar possible out of this asset during his life.”

Accordingly, the Court determined Jackson’s Interest in Sony/ATV had a value of $0.

JACKSON’S INTEREST IN MIJAC MUSIC [3]

Jackson’s ownership of Mijac Music was the only asset in which the Court determined the value to be closer to, albeit still below, the IRS’s estimations of value rather than Jackson’s Estate’s estimation, Jackson’s Estate estimated the value of Jackson’s interests in Mijac Music to be worth roughly $2.2 million; the IRS’s examiner and expert estimated values $58 million and $114 million, respectively. Unlike Jackson’s interest in Sony/ATV, his interest in Mijac Music continued to generate income for his Estate and was not burdened by insurmountable debt.

Both experts relied upon the Income Approach to value Jackson’s interest in Mijac Music. The final discrepancies in estimated value centered around the length and magnitude of a “spike in demand for Jackson’s music starting the moment his death was broadcast to the world.” This is a common phenomenon in the industry; the death of a celebrity, even if diminished in popularity, can generate extraordinary media attention and a corresponding spike in revenue for his or her products. These spikes are routine, but temporary, and the Court agreed that the spike would fade away after three to five years.

The Court determined that a hypothetical buyer would be reasonable to assume there would be a spike in demand for Jackson’s music similar to that of Ray Charles. The Court used Anson’s projected 461% spike and subsequent gradual decrease in years four through ten to base their projections on. In addition to the present value of the income of Jackson’s interest in Mijac Music, the Court also considered cash and liabilities on hand at the time of Jackson’s death.

The Court ultimately determined Jackson’s Interest in Mijac Music had a value of $107 million.

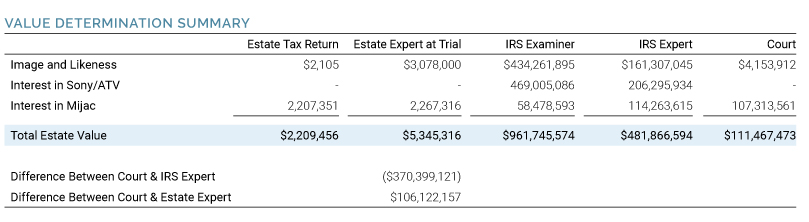

A summary of the values asserted by the Estate and the IRS as compared to the values ultimately determined by the Court is presented below.

CONCLUSION

While both the Estate of Michael Jackson and the IRS can appeal the Court’s decision, which would then be presented to the Ninth Circuit Court, it is important to note that this case is the first instance the Tax Court soundly rejected the IRS’s expert’s valuation approach in determining the value of name and likeness. In the Court’s opinion, Judge Holmes noted the “Government expert’s analysis – quite apart from the taint of his perjury – is unreliable and unpersuasive. It doesn’t value the correct asset, it includes unforeseeable opportunities, and it reflects faulty calculations.”

Judge Holmes summarized the future value of Jackson’s Estate by saying, “Just as the grave will swallow Jackson’s fame, time will erode the estate’s income. It resurrected and then sold what became its most valuable asset to Sony before trial. The value of what it has left, no matter how well managed, will now dwindle as Jackson’s copyrights expire and his image and likeness shuffle first into irrelevance and then into the public domain.”

HANCOCK FIRM

Hancock Firm provides comprehensive services for the valuation of business enterprises and individual’s estates, including the tangible and intangible asset components, such as those disputed in the Estate of Michael Jackson vs. Commissioner. We also assess values of relevant fractional ownership interests, which typically require quantification of lack of control and lack of marketability discounts. We also provide expert testimony on such matters involved in litigation.

[1] The King of Pop Beats the IRS in Tax Court Estate Case, May 4, 2021.

[2] McCarthy, Melville B. Nimmer Symposium, supra note 1 at 1706.

[3] Estate of Michael Jackson v Commissioner, Opinion, VII. New Horizon Trust III.

Articles by Hancock Firm do not provide legal, accounting, or other professional advice or opinion. If such advice is needed, consult with a professional at Hancock Firm or your attorney, accountant, or other qualified adviser.